Dollar Value ~ Book on The Valuation of Patents, Startups, Software and Other Intellectual Property Assets

Read the book here, reproduced on this page, or download the PDF ebook by clicking on the book image below. Note: Tynax provides valuation services, as described here.

CONTENTS

- Introduction

- Common Approaches to Valuation

- Market Forces of Supply & Demand

- Valuation of Established Businesses

- Valuation of Businesses In Mergers & Acquisition Transactions

- Valuation of Startup Companies In Venture Capital & Other Financings

- Valuation of Product-Lines

- Valuation of Software Code

- Valuation of Patents

- Valuation of Trademarks

- Valuation of Internet Domain Names

- Final Thoughts

- About the Author

INTRODUCTION

The price tags attached to intangible assets such as patents and startup companies can reach hundreds of millions or billions of dollars and there’s a misconception in the general public that these figures are the result of some form of black magic or insanity emanating from Silicon Valley. However, for those of us involved in negotiating transactions, where buyers acquire intangible assets such as patents and startup shares, the prices offered by buyers, and the prices ultimately accepted by sellers, are based on surprisingly solid foundations. This book describes the techniques used to assess real-world valuations of technology-oriented assets and explains how the prices offered by buyers looking to acquire the ideas and productions of inventors, creators, developers and entrepreneurs can be predicted with some accuracy.

The Concept of Value

Value represents the degree of importance or worth of an item and the dollar value is the price a ready, able and willing buyer is prepared to pay to buy the asset today. It’s as simple as that. In fact, this section is totally unnecessary as the concept of value is understood by anyone that has ever used money to buy something and needs no explanation at all.

Erm. Unfortunately, it’s not quite so simple. We do often translate the value in monetary terms, but the concept of value can be rather complicated. Indeed there’s a whole field of philosophy dedicated to this topic, not surprisingly referred to as “value theory”. Philosophers like Plato have debated the concept of value at great length. Nevertheless, when selling an intangible asset1 the buyers have little patience to debate value theory and even Plato would struggle to convince a buyer to pay more than the market rate.

In practice, the study of philosophy may have little bearing on the estimation of a dollar value for an asset but the study of economics does play a significant role. As we will discuss later on, the price does tend to increase with growing demand (perhaps creating a shortage), and it does tend to drop with growing supply (perhaps creating a glut). The value of an asset is affected by fluctuations in supply and demand, and these are affected by changes in the marketplace. Market conditions can have a significant impact on the value of an item, and prices can fluctuate with changing conditions. As an example, the value of a diamond in a large, thriving city will be much higher than the value of a bottle of water, but when conditions change and the setting moves to a dry desert miles from any water source, the value of the bottle of water could easily exceed that of the diamond. In economic terms, the supply of water in the desert is significantly smaller than the supply elsewhere, and in certain conditions, the demand for water in the desert can be significantly higher. As the technology sector is moving at a rapid pace, and markets are quickly being transformed by new products and new players, the value assigned to an asset like a patent or a startup company can be quickly rendered out-of-date. In some situations a valuation estimate can become obsolete within a matter of days.

Although we assess the value at a particular point in time, this doesn’t mean there are buyers lining up to write a check on that particular day. Attaching a price tag to an item does not mean the item will sell immediately at the marked price. Priced goods often remain on store shelves for months or years before being sold. Sometimes they’re not sold until the price is reduced or some sales promotion brings in a batch of eager buyers. The process of selling a company, selling shares in a company, selling patents and other assets takes time. Potential buyers need to be identified, approached and provided with information necessary for them to assess value for themselves to justify a purchase. If there are no buyers today, this does not mean the item has no value. It often means the sellers have failed to undertake sufficient marketing efforts to engage buyers. Finding, contacting, educating and convincing buyers requires effort and an outbound sales effort is usually necessary when realizing the value of a complex asset.

The appraised price for an asset is based on a number of assumptions and is affected by a number of factors. When we set a value for an asset, we can define this as the price a ready, able and willing buyer is prepared to pay to buy the asset today, but this is based on certain assumptions. For one, we are assuming the buyer is ready to buy today, but also we know that approaching the buyer can take some time and effort. The process of marketing an asset such as a patent, or shares in a startup company often takes around 9 months, so we have something of a time-delay to deal with. We have to look at the market today and estimate what a buyer would pay today, but we don’t have buyers ready to buy today, so we’re making something of an assumption. This example highlights how fragile and temporary the dollar value can be. Over time, fluctuations in supply, demand and changing market conditions can have a significant impact on the value.

Ultimately, when dealing with prices, we are dealing with the perceptions and behaviors of buyers and sellers. People can be unpredictable. Peering into the mind and predicting what a person, or a group of people, might do in a buy/sell situation is not an exact science. We can, however, analyze how buyers and sellers behave today when setting prices and make predictions as to how they would determine the value of an asset based on techniques commonly adopted in similar situations. Essentially, that’s what we will now proceed to do in this book.

1Let’s use the term “asset” to refer to businesses, shares and other company-related securities as well as patents, trademarks and other intangibles.

COMMON APPROACHES TO VALUATION

Valuation techniques involve looking at revenues flowing in, revenues flowing out, and the behavior and practices of buyers and sellers in the marketplace. We can look to the past to see if the asset has a history of generating revenues, we can look to the future to see what revenue and savings potential the asset might be able offer, and we can look around today at the present state of the market to see what prices are being agreed in similar transactions. Income approaches calculate value based on the future revenue streams, cost approaches mostly calculate at the cost of replacement, and market approaches calculate the value by comparisons with similar assets recently traded in the marketplace.

Let’s explore the mechanics of how values are calculated using these techniques, then we can move on to see how they are applied to different types of assets.

Comparables Approaches

When buying a house, especially a house on a street surrounded with similar or identical real estate, the value of the house is usually determined by looking at the prices similar properties have recently sold for on the open market. The house appraiser keeps track of similar properties and gauges the value of real estate based on comparisons. If your house is identical to the house next door, and that house sold for $400,000 just last week, it’s not difficult to assess the value of your house at $400,000 today. The next-door property is a good comparable when it’s virtually identical, in the same neighborhood and the sale was very recent in time. When assets are very similar, and there are recent asset sale transactions to indicate the state of the market, the comparables approach to valuation is very useful.

Adjust For Differences

Often it’s difficult, even in real-estate, to find highly similar properties, in the same neighborhood that have sold very recently, and adjustments have to be made when comparing one house to another. If a house a few blocks away recently sold for $500,000, but that house had an extra bedroom, and was in a better location, an appraiser might take that house into account as a comparable and adjust the price of your house to $400,000 to allow for the differences.

Compare with Closed Transactions not Advertised Prices

It’s important to compare with prices agreed by both buyer and seller—where the buyer is writing a check or otherwise tendering payment. If your neighbor loses her mind and places her two bedroom house on the market for a hundred million dollars, this price cannot be used as a comparable for your house until a real buyer agrees to the price, and ideally writes the check to close the transaction. For example, when looking at prices on eBay as a basis for valuation, you really need to look at the prices paid in sold, completed auctions, not the prices advertised by hopeful sellers. This is very true when dealing with the intangibles we are valuing in this book as many sellers advertise their patents, trademarks and other assets at very “ambitious” prices. Not surprisingly, these bazillion dollar listings result in few legitimate bids and even fewer sales. Making comparisons with advertised prices is not very useful, can be highly misleading, and we need to make sure we compare with closed transactions where buyers and sellers have reached agreement on price.

More Data Points Means More Accurate Comparables

The comparables method works best when there are lots of data points to work from—numerous sales taking place to indicate the market is buoyant and somewhat predictable. If your house was located in a complex surrounded by hundreds of virtually identical properties, and there were numerous houses sold each month, then you would be able to predict the value of your house and you would be able to track the pricing trends over time with some accuracy. However, if your house were located in an area where very few similar houses are ever sold, predicting the value will be more speculative. In markets with thin trading, the comparables method can be a little misleading.

Cost-Based Approaches

If your car were fully insured, but totally destroyed one evening by an asteroid hurtling out of the sky at enormous speed, you would likely claim on your insurance for the value of the car. You might be able to sell the asteroid but that’s another matter. In fact, don’t even think about selling the asteroid as this might send us off track. I wish I hadn’t mentioned it.

Anyway, what type of claim might the insurance company be prepared to pay you? As the car is destroyed, the insurer would likely pay you the cost of replacing the car. In many insurance situations, the car is valued at the cost of replacement. The value is based on the cost.

Let’s imagine you bought some land and built a house many miles from any neighbors, how would you value the house? If you dismiss the comparables approach to valuation on the basis there are no similar houses to compare with in the same neighborhood, you could assess the value of your newly built house based on the costs you incurred in building it. Let’s say you spent $100,000 on the land and $200,000 constructing the house, you could argue that the house is worth $300,000.

Cost-based approaches to valuation have some merit in certain situations and are often used when none of the other methods are suitable.

Replication Cost Approach

The value of the asset can be estimated as the cost of replicating it—creating an identical or highly similar copy. This might involve the cost of designing and fabricating the replica.

Replacement Cost Approach

Where the asset is fungible there are identical or highly similar assets available on the marketplace, the assets value can be estimated as the cost of buying a replacement. This approach might be considered a variation of the comparables approach to valuation, as they each require the availability of a similar asset available for sale with a market-driven price tag.

Imagine you lived on one side of a river, and the nearest town was on the other side of the river. You own a small bridge that you use each day to drive to the town, and you want to assess a value for the bridge. Well, the bridge is highly convenient to you, and if you didn’t have this bridge, you would have to spend $20 a day on gasoline driving to the nearest alternative bridge, many miles away. Your bridge saves you at least $20 a day in gasoline, and this could form the basis of your valuation of the bridge. The bridge saves you $7,300 per year, so over the next 10 years, this would account to savings of $73,000. If you plan on living in the house for 10 years, you could justifiably argue that the bridge is worth $73,000.

Earning $73,000 per year is very similar to saving $73,000 per year, and you may notice that the cost savings approach is somewhat related to the income approach to valuation.

Income Approaches—Discounted Cash Flow (DCF)

The income approach to valuation assesses value today based on income streams predicted to be generated in future, and the likelihood that the income streams will materialize according to the forecast. Where an asset or business operation generates a stream of revenues, its value can be determined by calculating the total net income the asset will generate in the coming years. The time-value-of money is then factored in to discount the future revenue streams to determine what those future incomes might be worth today.

The time value of money is a concept that is simple to understand. If someone offered you the choice of having $1,000 today, or a promise to give you $1,000 in twelve months’ time, you would likely go for the option paying you $1,000 today. This is the logical choice if you want to spend the money today, but it’s also the logical choice if you don’t need the money for twelve months, as you could invest the $1,000 and earn interest so that your money is worth more than $1,000 when it has been invested for the 12 months period. So, a dollar today is worth more than a promise of a dollar tomorrow. The difference in value is referred to as the “discount rate”, and the income stream projections, when adjusted by applying the discount rate, are referred to as the “discounted cash flows”. The total value today of all the discounted cash flows is referred to as the “net present value”.

Hold on to your hat, we’re now going to use a mathematical formula. The net present value of an asset is calculated as the sum of the discounted cash flows, and the following mathematical formula is used:

Where:

- DCF is the sum of discounted cash flows, or net present value of the future cash flow (CF).

- C is the net income (cash flows) projected for a future period;

- r is the discount rate and reflects the interest rate or the level of risk associated with the flows not materializing as projected;

- n is the time in years before the future cash flow occurs.

As an example showing how a simple discounted cash flow analysis might be applied:

- Projected net cash flow, year 1 (after tax) = $1 m.

- Projected net cash flow, year 2 (after tax) = $2 m.

- Projected net cash flow, year 3 (after tax) = $2 m.

- Discount rate = 30%

- Discounted cash flow projection, year 1 = $1 m / (1.30) = $0.77 m.

- Discounted cash flow projection, year 2 = $2 m / (1.30)2 = $1.18 m.

- Discounted cash flow projection, year 3 = $2 m / (1.30)3 = $0.91 m.

- 3 year cash flow = $1 m + $2 m + $2 m = $5 m.

- 3 year discounted cash flow = $0.77 m + $1.18 m + 0.91 m = $2.86 m.

This example shows that a projected cash flow of $5m with $1m in year 1, $2m in year 2, and $2 million in year 3 would have a net present value today of $2.86m after the discount rate of 30% per year is applied. If a discount rate of 5% is used instead of 30%, the value of the same ($1m+$2m+$2m) income stream is $4.49m. Clearly, under this valuation method, the value of a revenue stream is heavily affected by the discount rate that’s applied. So, what discount rate do you choose for a particular income stream? The answer is driven by the risk factors involved. The higher the probability the income streams will not materialize as projected, the higher the discount rate that should be used.

If the risk factor is very low, the income is essentially guaranteed (by an unquestionably reliable guarantor), then the discount rate used should be equivalent to the rate of interest that you could earn by putting the cash in the bank, or another form of secure, interest-bearing account. If the interest rate you could earn on cash deposits is 5%, it’s reasonable to use this 5% figure as the discount rate when calculating the discounted cash flows from guaranteed, secure income streams. For investors, the discount rate reflects the opportunity cost as well as the risk associated with the investment in question. If an investor is able to earn a return on an alternative investment, this is factored in to setting the discount rate to be applied to a particular investment. Investors calculate the discount rate by calculating the internal rate of return, a rate of return that is specific to their particular business.

Clearly, the discount rate should increase with the level of risk associated with the opportunity, but there are no hard and fast rules about which discount rate to apply to an income stream. Investors calculate the rates based on their understanding of the business or assets involved, their tolerance to risk, and the alternative investments opportunities they have available. Nevertheless, this table might represent a useful guide:

| Risk of Income Failing to Materialize | Projected Income Streams | Discount Rate (Example) |

| Zero, or extremely low. | Virtually guaranteed. | 5% |

| Low. | Highly predictable. | 10% |

| Moderate. | Somewhat predictable. | 20% |

| High. | Speculative. | 30% |

| Extremely high. | Highly speculative. | 40%+ |

Investors accustomed to applying discount rates to real estate investments, government bonds and securities offered by large, stable corporations are familiar with discount rates in single digits or law double digits. The traditional investors might be unaccustomed to the high discount rates applied to intangibles such as startup companies, patents and high-risk ventures such as lawsuits. The valuation of startups, especially early-stage startups involves unusually high levels of risk, so the discount rates applied in these scenarios can exceed 50 or 60%, and seed stage investors can use discount rates as high as 80%. Investors in high risk ventures such as seed stage startup companies, where more than nine out of ten investments fail, will apply high discount rates as high as 70%2. Intangible assets and investments in the technology sector involve some of the highest risks in business and this is reflected by use of some of the highest discount rates in valuation calculations.

2“Venture capitalists typically use discount rates in the range of 30 to 70 percent. During the startup stage of venture-capital financing, discount rates between 50 to 70 percent are common.” WHY DO VENTURE CAPITALISTS USE SUCH HIGH DISCOUNT RATES?. Sanjai Bhagat, University of Colorado at Boulder.

MARKET FORCES OF SUPPLY & DEMAND

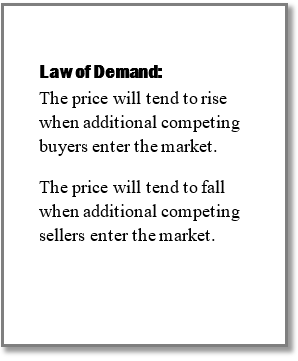

In a free market, the rules of economics govern the price of companies, shares and technology assets as well the price of apples, oranges, jet planes and everything else. A principle you should consider when considering price says that the price will tend to rise when you introduce additional competing buyers; and conversely, the price will tend to fall when additional competing sellers are introduced to the marketplace.

Let’s take the example of an old-school farmers’ market for fruit. Let’s say that on any particular market day, there are 10 farmers selling apples and 100 customers buying apples and all the apples are of similar quality. The market has settled at a price of $1 per pound and all the vendors are selling at or near the $1 per pound price. This state of affairs continues for some time, then one Monday, a passenger train breaks down nearby. A thousand hungry passengers leave the train to find food and hurriedly enter the farmers market. The 10 farmers with stalls suddenly find themselves with lines of hungry customers asking for apples. One customer standing in line realizes there are not so many apples to go around, he might go hungry and waves a $10 bill at the farmer, saying “forget your $1 asking price, I’ll pay $10 for a pound of apples”. The farmer duly accepts, and realizing other customers will pay the same price, he resets his price tags increasing the price for $1 to $10, then starts selling to other customers at the new $10 per pound price. Other farmers see what’s happening, and they set the price at $10 per pound. As the apples become start to sell out, a farmer sets the price at $20 per pound, and even he manages to sell out of apples as customers continue to flow into the market from the train and are grow increasingly anxious to buy. Farmers call home and tell their farm hands to go out and pick as many ripe apples as they can.

That evening, the farmers go home with pockets filled with cash from their memorable day, tell their families and friends and one farmer is so pleased with his sales that he buys drinks for everyone that evening in the local sports bar. Word quickly spreads about the “fortunes” being made in the farmers market, and local orchards are quickly picked empty of ripe apples. The following day instead of 10 farmers showing up at the market with their produce, there are 40 farmers, each bringing all the apples they could harvest. Stalls are piled high and the number of apples for sale on the market (supply) is huge compared with the regular daily offering.

As you guessed (but the farmers clearly didn’t), overnight the train was fixed and the passengers went off on their merry way. Where there were 1,100 customers on Monday, the numbers were back to the regular 100 customer levels on Tuesday as there were no train passengers to cater for. Instead of lines of hungry customers at each stall, customers on Tuesday are few and far between. Farmers take to calling out at customers to attract them to their stalls, and quickly start to entice them with prices. The $10/pound price tags written up on Monday are quickly discarded and the old dollar a pound price tags replaced. Looking at his pile of ripe apples for sale, one farmer decides he doesn’t want to haul his stock back home at the end of the day, only for them to rot and get thrown away, so instead of one pound, he starts to offer two pounds of apples for a dollar. He quickly sells out, packs his truck and heads off home. Other farmers left at the market with stockpiles of apples notice that customers numbers are dwindling. To sell their stock, farmers start to offer apples at 3 pounds, then 4 pounds for a dollar. By the end of the day, the price has dropped to ten cents per pound as farmers become desperate to sell their stocks apples while they’re still fresh. Even at these prices, many farmers go home with stocks of apples and they’re not too happy.

On Monday, we saw an increase in demand, new customers came into the market and the price increased as a result. Tuesday we saw an increase in supply, new sellers came into the market, and prices dropped like a stone.

Whether or not you like apples, you agree with increasing food prices for hungry, stranded train passengers, or you work on the trains, this example shows how the price of an item is affected by fluctuations in supply and demand. These effects can be very obvious in active markets made up of large numbers of buyers, large numbers of sellers, and large numbers of transactions, but the effects can also be found in smaller markets, where there may be only a few sellers and buyers.

Let’s change the hypothetical to an asset with a higher price tag. Imagine you’re under financial pressure from creditors, you’re selling your house to clear the debts, and you come across a buyer who offers you a reasonable price. You indicate that the offer price is reasonable and that you would be happy to accept. The buyer then suspects that you might be willing to accept a lower price, and decides to offer you a reduced price. If you’re desperate to sell, and this is the only buyer in the market, you may be forced to accept the reduced price. If, however, there’s another bidder equally interested in the house, you would likely refuse to accept the reduced price. What’s more, knowing there’s another bidder, the buyer will be less likely to try to negotiate the price and a higher price can be more easily supported. Savvy sellers will carefully play one buyer off against another, making sure each one is aware there are other bidders in the game.

In this scenario there’s only one seller and a couple of buyers but the forces of supply and demand have an influence on the price. In virtually any market, adding additional competing buyers will tend to push up the price, and the price will tend to drop when additional sellers enter the fray. For sellers wanting to increase the price, engaging additional buyers is one of the most effective techniques. Buyers are aware of this, will try to engage competing sellers and can look to restrict the numbers of bidders in order to keep prices down.

Now that we’ve introduced the concept of the cost-based, income-based, and comparables-based valuation techniques, with the law of demand, let’s investigate how these techniques might be applied to various intangible assets and valuation scenarios.

VALUATION OF ESTABLISHED BUSINESSES

In contrast to startups, which we will discuss later, an established business is generating sales revenues and has cash flows to measure and drive the valuation calculations. With company shares traded on public stock markets, a good deal of data is available for analyzing the potential value of an established business. Fortunes can be made or lost overnight on Wall Street and investors have developed sophisticated methodologies for predicting the values of companies, and the resulting values of their shares.

PUBLICLY TRADED COMPANY STOCKS

In the Wall Street crash of 1929 many investors lost their savings, quite a number lost their shirts, and some took to jumping from tall buildings. As a result, the U.S. government formed the Securities Exchange Commission (“SEC”) as a federal agency with responsibility for enforcing the federal securities laws and regulating the securities industry, the nation’s stock and options exchanges, and other electronic securities markets. Securities comprise company shares, bonds and virtually any investment instruments, so the SEC has broad powers to control how companies raise finance from U.S. investors. In 1933 and 1934 the government enacted rules3 that are still enforced today by the SEC and have the effect of requiring companies to register their shares (with the SEC) before they are allowed to be sold to the public. Registration of the shares is a costly process and triggers some onerous reporting requirements for the Company selling the shares, and its management and advisors. Following registration, the shares are able to be sold to the public in an initial public offering (“IPO”).

The SEC-enforced rules are essentially designed to force companies to disclose full and accurate information to investors, and to protect small “unsophisticated” investors. So long as investors are fully informed of all material information on the business, there’s no requirement that a company be solvent or be of a minimum size. As far as the SEC’s concerned, you’re free to sell bad eggs, as long as they are labeled as “bad eggs”.

At any time, a company can decide to register its shares with the SEC and then sell them to public investors. From that point on, the Company will be required to disclose detailed financial and business information to the public, and the share price will be traded, tracked and published. Calculations based on the financial reports of these companies, and the share price, provide insights into valuation.

We will learn a little later on that venture capital investors almost always structure their investments in startup companies as preferred stock and create a multi-tiered stock arrangement where founders and employees have common stock and investors hold more valuable preferred stock. This is somewhat complicated and not very appealing to public investors, so when the Company registers its shares and sells shares to the public via an initial public offering, the preferred stock is converted to common stock. The preferred stock disappears and common stock is the only type of share sold to public investors. This makes life simple when calculating valuation because the value of the Company can usually be determined directly from the current share value. A publicly traded company (with only common stock), with a current share price of $10.00 per share and 70 million shares outstanding will have a value of $700m, calculated as 70m shares at $10 each. If the share price increases to $11.00 on a Wall Street trading day, then the value of the Company increases to $770m on that day.

Where there are usually millions of shares registered for sale by any particular company, and large numbers of buyers and sellers trading in a vibrant stock market, the law of demand4 comes into play. Forces of supply and demand are driven by information available on the Company and its financials, and these forces drive the price of any particular share at a point in time5.

The value of individual shares traded on the public markets are driven by market forces and extrapolated to find the value of entire companies. You will see that we can use this data to assess the value of other companies, even those that are not publicly traded but privately held.

3Securities Act of 1933 and the Securities Exchange Act of 1934.

4See Market Forces of Supply & Demand, above.

5We further investigate the relationship between information and share price in Efficient Capital Market Hypothesis, below.

Valuing Established Businesses Using a Comparables Approach

Comparing one company with another, or with a group of companies, is a commonly-used method of valuing established businesses. When you’re looking to determine the value of a company, the ideal scenario is that you find another company with a known value in the same line of business with virtually identical financial performance and virtually identical prospects, then you can use this as a yardstick. If a company identical to yours recently sold for $10m, in the same sector with the same prospects, you can argue that your company is also worth $10m. If a company recently sold at $100m, but that one was ten times the size of your company, you could argue that your company is worth one tenth that value, i.e. $10m.

Businesses can be compared based on their profits, their overall sales and a number of criteria, and adjustments need to be made when comparing companies for the purpose of valuation.

Liquidity Discount for Comparing Private Companies with Publicly Traded Companies

Before we explore the comparables valuation techniques, as applied to established businesses, let’s investigate the differences between the values of publicly traded and private (“closely held”) companies. An investor holding a share of stock registered with the SEC and publicly traded is readily able to sell that share on the public stock markets6. Shares in publicly traded companies (SEC reporting) are more liquid than shares in private companies as they can be sold, and converted to liquid assets—i.e. cash. Therefore, shares in private, closely held companies are considered less valuable than those in similar publicly traded companies.

A private company is normally assessed to be worth less than a public company. This is because the stock in a privately held company is not tradable—it’s not liquid and is therefore less valuable to an investor. A “liquidity discount”, often of the order of 25-33%, has to be applied when comparing private companies with public companies in the same sector.

If two companies were identical, operating in the same business sector, but one had shares that were registered and readily traded on the public stock markets whereas the second company was privately held, with shares that were restricted from public sale, the value of the private company would be estimated by applying a liquidity discount to the value of the public company.

If the share price on the public stock markets valued the public company at, say $100m, the value of an identical private company would be perhaps $70m after applying a liquidity discount of 30%.

6 Some stocks are more liquid than others. Some shares are “thinly traded” and for under-performing company stocks, it may not always be possible for a seller to find buyers, even on public stock markets. The liquidity discount for thinly traded shares would be lower than actively traded shares, but higher than zero as the market for registered shares is open to the public, so is much larger than the market for unregistered shares.

Comparing Revenue Multiples for Established Businesses

The value of a company can be estimated by comparing its sales revenue with the revenues of similar companies with known valuations. The valuations of companies can be known if they have recently been acquired and the purchase price is disclosed, but most often the valuations of comparable companies can be calculated from the price at which their shares trade on the public stock markets.

We can use the revenues of companies as a basis for comparison. Let’s say we’re estimating the value of a business operating in the widget industry where the total revenues of all the publicly traded widget companies companies over the last 12 months was $100m and the total valuation of these companies, based on their publicly traded share prices, is currently $300m. You can estimate that the revenue multiple for this industry is 3X. The value of the Company is three times the Company’s annual revenue.

If our business has revenues of say $10m over the last 12 months, we would therefore estimate the value at $30m, calculated at $10m multiplied by the revenue multiple of 3 for the widget industry. If our company were private, and the shares were not registered for sale on the public markets, then we would have to apply the liquidity discount and the calculation might look as follows:

- Company’s revenues (for last 12 months) = $10m.

- Average revenue multiple for (public co.’s) in this industry sector = 3X.

- Company valuation (public company) = $30m.

However, if our company is private, and the revenue multiple was calculated by looking at comparable publicly traded companies, you have to apply the liquidity discount.

- Company valuation (private company) = $22.5m (after applying liquidity discount of 25%).

If our shares were publicly traded, the Company might be worth $30m, but if it remains privately held, after applying the liquidity discount, the value might be closer to $20m.

Comparing Earnings Multiples for Established Businesses

The revenue multiple valuation method may be subject to criticism in that it looks at the top line revenue and fails to consider if the Company is profitable. A profitable company with low revenues could well be worth more than a loss-making company with large revenues.

The earnings-multiple valuation method looks at the bottom line. The Company valuation is based entirely on its earnings performance.

Firstly, the price/earnings ratio7 for the industry is calculated by comparing the valuation of public companies with their earnings. If all the companies in the sector generated a total of $100m in earnings and the total market value of these companies is $2Bn, the multiple is calculated at 20—the ratio of price to earnings.

- If the Company’s earnings (for last 12 months) were $10m,

- The Average Price/Earnings (‘P/E’) ratio for (public co.’s) in this industry sector is 20X.

- Then the Company valuation (for a public company) is $200m.

- After applying liquidity discount, the value of a privately held Company might be $150m.

7 There are multiple versions of the P/E ratio, depending on whether earnings are projected or realized, and the type of earnings: “Trailing P/E” uses net income for the most recent 12 month period, divided by the weighted average number of common shares in issue during the period. This is the most common meaning of “P/E” if no other qualifier is specified. Monthly earnings data for individual companies are not available, and in any case usually fluctuate seasonally, so the previous four quarterly earnings reports are used and earnings per share are updated quarterly. Note, each company chooses its own financial year so the timing of updates will vary from one to another. “Trailing P/E from continued operations” uses operating earnings, which exclude earnings from discontinued operations, extraordinary items (e.g. one-off windfalls and write-downs), and accounting changes. “Forward P/E”: Instead of net income, this uses estimated net earnings over next 12 months. Estimates are typically derived as the mean of those published by a select group of analysts.

Valuing Established Companies Using an Income-Based Approach

With a projection of the future profits to be generated by the Company, it is possible to use discounted cash flow analysis to determine the Company’s valuation. Indeed, this method is adopted by the courts (especially Delaware courts8 which is most active in business cases) to determine a “fair market value” of a business in cases where shareholders are asking the court to settle a dispute and provide an appraisal on a company’s value.

The value of a business is estimated to be the net present value of the cash flows generated by the business in the coming years, and the discount rate applied is determined by assessing the risks that the projected cash flows are likely/unlikely to materialize. If we take the cash flow example we discussed previously9 and assume these cash flows were forecast by a company, we would see that the company was estimating profits of $1m in year one, and $2m in years 2 and 3. The total net profits are $5m over the next 3 years, but after applying a discount rate of 30%, the net present value is calculated at $2.86m today. So, in this scenario, the value of this profitable business is estimated at $2.86m.

As you can see, the discounted cash flow method of appraisal adopted by the courts can set a relatively low valuation, especially when dealing with sectors like high-technology where the P/E ratios are high. Let’s say our company in the example above (with projected net income streams of $1m, $2m and $2m) reported a net income over the last 12 months of $1m, and the P/E ratio for companies in this sector is 20X. This would provide us with a valuation using the comparables P/E approach of $20m—somewhat higher than the $2.86m valuation driven by the discounted cash flow method. So using an earnings multiple approach, a profitable technology-oriented business could be valued significantly higher than it would be appraised by the court using a discounted cash flow method. However, the discounted cash flow calculation is not discarded as being unrealistic in the technology sector.

The discounted cash flow method can be applied to any form of income stream, which makes this technique useful for comparing shares, bonds, real-estate investments and many different forms of investments. Perhaps that’s why this technique is used by the courts. By constantly comparing the revenue streams and discount rates across a wide range of investment types, the value of companies should theoretically be kept in check—the income returns generated by a company and its stock will be compared with those generated by alternative assets10.

8For example, see Gearreald v. Just Care, Inc., C.A. No. 5233-VCP (Del. Ch. Apr. 30, 2012); In re Appraisal of The Orchard Enterprises, Inc., C.A. No. 5713-CS (Del. Ch. July 18, 2012).

9See Income Approaches—Discounted Cash Flow (DCF) above.

10Nevertheless, sometimes investors lose their heads and bubbles, such as the dot com bubble, grow as company valuations get extremely high, then fall through the floor as bubbles burst with dramatic effect.

Valuing Established Companies Using a Cost-Based Approach

How do you calculate the cost of replicating or replacing an established business? As it takes many years to establish a business, building goodwill and a reputation in the industry, replicating or replacing a business as a going-concern is not a simple task.

It might be reasonable to use the costs incurred in forming a business, or the total cost of funds invested in the business as the basis for valuation of a startup or an early-stage company, but as the Company matures into an established business, it becomes increasingly difficult to estimate the costs associated with generating goodwill. This is a book about valuation of intangibles, but assessing the costs associated with building all the intangibles associated with an established business is highly speculative. We can estimate the costs associated with building the framework of a business, but the magical elements that go into turning the framework into a profitable venture are too intangible to estimate with an acceptable degree of accuracy. The replacement, replication and cost-savings approaches to valuation are not very suitable for established businesses.

Exploring Wall Street Behavior & the Valuations Attributed to Businesses by the Public Stock Markets

A great deal of research has been undertaken with regard to understanding the motivations and activities of Wall Street and investors in the public stock markets. The various valuation methods adopted by Wall Street investors are well documented and studied. In this book, I’m trying to focus on valuation scenarios that are not so well understood, like intellectual property and startups, and I will not be covering many of the methods adopted by investors to value options, bonds and many of the derivatives that are traded on the public markets. There are many books available to explain these methods. However, some of the principles and theories adopted by public investors do have a bearing on the valuation of I.P., startups and intangibles, so let’s briefly take a look at the efficient capital market hypothesis, the capital asset pricing model and an introduction to behavioral finance.

Efficient Capital Market Hypothesis

We know from the law of demand 11 that the price of a stock at any point in time is driven by supply and demand for that stock at that time. The efficient market hypothesis (“EMH”) investigates the relationship between the information available to investors regarding the Company issuing the stock, and their decisions to buy (increase demand) or sell (increase the supply). The hypothesis asserts that financial markets are highly efficient in the way information translates to stock prices. Proponents of the ‘strong” version of the hypothesis believe share prices instantly reflect all the information about a company and its prospects, even hidden or “insider” information. They believe investors are highly efficient at gathering all the relevant information and making buy/sell decisions quickly based on this information. The “weak” form EMH claims that prices on traded assets (e.g., stocks, bonds, or property) already reflect all past publicly available information. The semi-strong-form EMH claims both that prices reflect all publicly available information and that prices instantly change to reflect new public information.

The price of a stock certainly reflects the information available to the investors and the capital market as a whole. However, the degree of efficiency is something debated by scholars and some lawyers who oppose the insider trading rules adopted by the SEC to restrict executives and other company insiders from trading on shares using inside information, at the expense of public investors. It’s useful for us to be aware of this hypothesis, if only to shed more light on the way information affects supply, demand and ultimately the price of shares in publicly traded companies.

11See Market Forces of Supply & Demand, above.

Capital Asset Pricing Model (CAPM)

Some stocks fluctuate wildly in price and are more volatile than others. Highly volatile stocks are more risky, yet more potentially profitable. Under the Capital Asset Pricing Model, β refers to the volatility. The average level of volatility for the whole market is determined and given a value of 1. A stock with average volatility has β=1. The Capital Asset Pricing Model relates the volatility of the stock to its price. A stock with β>1 is more volatile than the market average.

Under the Capital Asset Pricing Model, volatility is a factor considered by buyers, and some stocks are clearly more volatile than others. Highly volatile stocks are more risky, yet potentially more profitable.

Valuing the Company using the discounted cash flow method, the discount rate applied should reflect the β or volatility rate for the Company according to this model.

Behavioral Finance

Behavioral finance studies behavior of buyers and sellers and is based on the notion that investors are human, and often act irrationally. People hold on to stocks that a rational computer would sell, and sell stocks that a rational computer would hold. Egos and emotions come into play. Many decisions are driven by greed and fear. People don’t want to be proved wrong and sometimes avoid making difficult decisions.

Investors tend to flock. When one sells, others are influenced to sell as well. When one buys others will follow. This human behavior is not restricted to publicly traded stocks and appears in buyers and sellers of all assets. Analysts predicting the value and movement of a stock have to take into consideration investor behavior, and cannot assume that all humans act rationally all the time. The value of a share, and the aggregated valuation for the whole company, are not exact and are subject to the vagaries of human nature.

Setting the Share Price (& Company Valuation) at IPO

As soon as the Company’s stock is traded on an open exchange, its valuation is effectively set by market forces of buyers and sellers on Wall Street and the public stock markets, using the methodologies and techniques discussed above. How is the stock price determined at initial public offering (IPO)? This is not a simple task, as the forces of supply and demand have not yet been allowed to operate freely on account that the shares have so far been unregistered with the SEC and restricted from sale.

In the weeks running up to the IPO, the underwriters drag the CEO, CFO and other key members of the management team out of the office and parade them in front of potential investors and analysts in key cities across the country. The purpose is to generate investor interest in the Company and essentially pre-sell blocks of shares in advance of the IPO.

The road show consists of a fairly elaborate formal presentation on the Company’s operations, financial condition, performance, markets, products and services—and enables investors to meet face-to-face with management. There are breakfast meetings, lunch meetings, dinner meetings, group meetings, one-on-one meetings, investors meetings, broker meetings, underwriter sales force meetings, meetings about meetings, meetings within meetings.

Road shows are normally conducted before the prospectus has met the approval of the SEC. It’s at, or following, these meetings that institutions, and brokers, let the underwriters know whether they’re interested in buying shares in the IPO. The underwriter gathers these commitments in a ‘book’ and it’s at this point that the viability of the IPO can be more realistically assessed.

Normally the offering is priced just before the underwriting agreement is signed, on the day before the IPO. At IPO, the Company’s shares (or some of them) are openly traded and market forces—supply and demand—set a price. As market forces set this price, it can be argued that this is the first true valuation of the Company and its shares.

There are a number of different and conflicting forces at play in the process of pricing shares for IPO. The Company wants to set the price as high as possible, to maximize the proceeds of the share sale, the underwriter wants to set the price low enough that all the shares are sold, and the investor wants to see an early rise in the price after trading opens.

If the price is set too low and goes through the roof on trading, privileged investors, who got in at the offering price, make out like bandits—and the Company receives only a small fraction of the proceeds it might otherwise have had. If the price is set too high, the Company takes home a lot of money, but its stock could quickly plummet below the offering price as trading continues, resulting in negative publicity and unhappy investors.

Fortunately, after gauging investor interest at the road show, the underwriter will have a feel for what price the market will bear and make a recommendation as to the share price for management approval. For years, underwriters used a general rule of thumb: Value the deal so that the stock will jump about 15 percent on the first day of trading. This can be more of an art than a science.

Driving Demand & Increasing the Price When Selling Shares in Publicly Traded Companies

Company shares cannot be promoted and marketed in the same way as products or services. In the days before the SEC and government regulation designed to protect investors, shares were hyped to generate demand and subsequently increase the share price.

Pumping up the value of a stock and then dumping it on the market is an age old scam (“pump & dump”). Here is a drawing of the night singer of shares with his magic lantern pumping stock to unwary investors in 1858. Even the smartest investors can be duped. Sir Isaac Newton lost a fortune in this South Sea Bubble when the shares of the South Sea Company grew almost ten-fold within a matter of months—only to subsequently collapse. The pump and dump strategy continues today through organized crime and Internet scams, but is highly frowned upon by the SEC and the U.S. Justice department.

Following the Wall Street crash in 1929, Roosevelt’s new deal government passed several new laws aimed at regulating banking, the sale and trading of shares and other securities. The Securities and Exchange Commission was created to enforce these and other securities-related regulations and looks carefully at the way companies promote their shares. Information disclosed to the public about the Company’s performance and prospects, and about anything that might influence the buying or selling of shares is highly regulated by the SEC.

In the run up to the IPO, the SEC requires companies to enter a “quiet period” where investors are directed to the prospectus, which is approved by the SEC, and other communications by officers of the Company in the press, twitter, and any channels are highly restricted. The idea is that investors look to the prospectus for information, that the information in the prospectus is accurate and complete, and that other channels of communication are quiet for the period running up to the IPO. You may remember that the founder of Google was sanctioned by the SEC for a Playboy interview that was published just before Google’s IPO. This is an example of how executives are required to refrain from promoting their companies and shares in the quiet period.

Following the IPO, the gags are released but communication with the public is still highly regulated and controlled. Where we will see later on that marketing of companies, patents, and other intellectual property assets can help attract buyers and increase the price, this is somewhat difficult when dealing with companies reporting to the SEC12.

12The SEC has counterparts in all advanced countries, with very similar rules and operations.

VALUATION OF BUSINESSES IN MERGERS & ACQUISITION TRANSACTIONS

Valuations are instrumental when companies are acquired in merger or acquisition transactions. The price paid to acquire a company sets an accurate valuation for that particular company at that point in time, especially when the acquisition is all financed in cash. When the acquisition is financed in stock, and shares in the acquirer is exchanged for stock in the acquired company, another step in the valuation process is necessary to determine the fair market price of the stock exchanged, and the valuation figures produced can be somewhat more subjective than a pure cash transaction.

Valuation Techniques for Mergers/Acquisitions

Companies acquired in merger/acquisition transactions are usually established businesses, so the valuation techniques we discussed in the previous chapter13, including revenue multiple, earnings multiples and discounted cash flows are the methods often used. Of course, when comparing a privately held company with a public company, we will apply the liquidity discount14.

Investment banks and business brokers engaged to sell companies will often prepare a set of valuation metrics identifying comparable companies that have recently sold, and applying a variety of techniques. The bankers may produce a detailed report analyzing the financial performance of the business, estimating the value based on comparables of income multiples, revenue multiples, discounted cash flow estimates of the projected income streams. They select the most flattering techniques, take a weighted average of them all and produce a detailed valuation report to justify the highest valuation possible. Depending on the number of bidders interested in the acquisition, the bankers then negotiate price alongside other factors in the acquisition deal structure.

13See Valuation of Established Businesses, above.

14See Liquidity Discount for Comparing Private Companies with Publicly Traded Companies, above.

Minority Discount & Control Premium

Although the forces of supply and demand are expected to set the value of a company when shares are readily traded on the stock markets, the price offered by corporate acquirers usually represents a value somewhat higher than the current price-per-share. Corporate acquirers usually pay a price 10-50% higher than the prevailing stock market rate when acquiring a controlling interest in a company. The additional value is justified as a “control premium”. If the current stock market price is $10 per share, it is not unusual for an acquirer to bid $11, $12, even $15 per share when buying the whole company (or sufficient shares to control the whole company).

Although a price premium is regularly paid when acquiring control of a publicly traded company, this is not interpreted by the courts as a blanket rule that a share representing a minority interest is automatically worth less than a share held as part of a controlling interest. The Delaware courts, where most corporate disputes are resolved in the U.S., has refused to support arguments by controlling shareholders that the shares held by minority shareholders are necessarily inferior in value.

There may be a control premium, but this does not imply a minority discount. The forces of supply and demand may require a corporate acquirer to increase the offer price in order to buy a large number of shares, but this does not mean the shares held by a small shareholder are automatically junior in value to the shares held by large shareholders. We will discuss this further when we look at court appraisals.

Court Appraisal

Minority shareholders that do not accept the acquisition offer but are forced to sell can seek a fair value for their shares from the court 15. The acquirer of a public company may acquire sufficient shares to control the board of directors and elect management, but some shareholders may hold out and refuse to sell. Once the acquirer has sufficient shareholding, the minority shareholders can be forced to sell their shares by law.

Minority shareholders that do not accept the acquisition offer from the buyer, but are forced to sell, can seek a fair value for their shares from the court . The court then appraises the shares and determines the value. Experts can help the court determine the fair value for the shares—at the time of the merger. As we discussed earlier 16, courts prefer the discounted cash flow valuation method.

The buyer may be required to offer a premium over the current share price in order to buy the whole company, or sufficient shares to take control of the whole company. However, as we mentioned elsewhere17, the courts do not apply a minority discount in these appraisals.

In a 2 step merger—when the second step involves forced acquisition of the dissenting shareholders shares, the value of the Company

- with

the synergies of the merger are considered. So, the dissenting shareholders may resist the sale, but participate in the benefits of the merger as a result of the court appraisal.

15Pueblo Bancorporation v. Lindoe, Inc. 63 P.3d 353. Colorado. 2003; Cede & Co v. Technicolor, Inc. 684 A.2d 289. Delaware. 1996.

16See Valuing Established Companies Using an Income-Based Approach, above.

Driving Demand & Increasing the Price When Selling Companies in M&A Transactions

Buyers are almost always prepared to pay a higher price when bidding against others18. The negotiating power of the seller is strengthened when additional buyers join the bidding process. The banker or intermediary representing the seller in an M&A transaction can earn its commission, and push up the price considerably, as the result of an effective marketing campaign attracting several bidders.

Some buyers are prepared to pay more than others—a strategic buyer that’s interested in the technology, patents, teams, distribution channels and other components will likely pay a higher price than a financial buyer that’s solely interested in the cash flow.

The ideal scenario for the seller is that auction-fever takes hold with a number of strategic buyers, ideally head-on competitors with deep pockets, who bid up the price to the benefit of the entrepreneur.

Selling companies involves selling “securities”, so the process is governed by rules enforced by the SEC, and the information disclosed to potential buyers has to be full, fair and accurate. It might be enticing for a company to attract bidders by making exaggerated claims about financial results, orders or future prospects, but this is against the law in the U.S. and virtually every other country. It’s called “fraud” and comes with some heavy penalties, so all efforts to attract buyers must be based on accurate information.

17See Minority Discount & Control Premium, above.

18See Market Forces of Supply & Demand, above.

19See SEC Rule 10b-5 & sections 11 & 12 of the Securities Act.

VALUATION OF STARTUP COMPANIES IN VENTURE CAPITAL & OTHER FINANCINGS

Valuation techniques, such as comparable earnings multiples and revenue multiples, are not relevant to startup companies where there are no earnings, and often no revenues to compare. Without a history of sales revenues, venture capital and other startup investors rely on other techniques for startup valuation.

In fact, because venture investments don’t involve an acquisition of the Company, or an acquisition of regular shares in the Company, there’s a compelling argument that venture capital investments do not form the basis of valuation for a startup. Acquiring stock in a private company is not the same as acquiring the whole company or acquiring publicly traded stock.

Pre- and Post- Money Valuations

The valuation method commonly used by venture capital investors20 when looking at startup companies involves a projection of the possible return on investment.

The beauty and intrigue of this method is that a value is placed on the Company with little reference to the market, the technology, the team, milestones achieved or momentum generated to date. In fact, the only information an investor requires from the Company is a copy of the capitalization table, showing a breakdown of the shares held by all the shareholders. With this information, details of the amount of money the investor is injecting, the value of the Company at a point in the future, say 3 years from now, and how much the VC wants its investment to be worth at that point, the investor works out how much of the Company it needs to own today—and from here they can determine the current company valuation.

As an example, the investor may estimate that, if all goes to plan, the Company would be worth $100m three years from today. At that time, the Company valuation is estimated at $100m based on comparable M&A transactions, typical earnings & revenue multiples in this business sector.

If the total number of shares issued by the Company in three years’ time is estimated at 20m (after allowance for future rounds of funding), and the VC wants to own 15% of the Company15 at this point, the investor needs to acquire 3 million shares.

If it’s going to achieve a 10x (1000%) return on investment, the VC needs to buy 3m shares today at a price of $1.5m.

With 10m shares outstanding today (before shares are sold in later rounds), this sets a value for the Company of $5m today. The investors needs to buy 3m shares for $1.5m, so the share price is 50 cents per share. With 10m shares outstanding and a share price of 50 cents each, this theoretically values the Company at $5m.

Although it seems to have little relationship with the Company, the milestones achieved or momentum generated, the Return on Investment technique is commonly used by investors in seed and early stage companies.

20 Variations of this method are often referred to as the “Venture Capital Method” of valuation. The Venture Capital Method was first described by Professor Bill Sahlman at Harvard Business School in 1987.

21The top-tier Sand Hill Road firms are looking for a substantial share of the Company—normally in the region of at least 15-20% when acting as lead investor—otherwise they can’t justify placing a partner on the board of directors and committing to add the Company to the VC’s portfolio of investments.

Preferred Stock—Why Venture Capital Investments do NOT Represent a Sound Basis for Company Valuation

When a venture capital investor presents a term sheet to invest in an early-stage technology-oriented startup venture, it’s something of a stretch to use the financial terms of the financing to extrapolate a valuation for the whole company. Almost all venture capital investments are structured as preferred stock financings where the investor acquires preferred stock with rights to convert to common stock and several preferential rights over and above those of common stockholders. The preferred stock arrangement has significant implications on control of the venture, and the investor has liquidation preferences that distort the distribution of proceeds when the Company is sold. The preferred stock instrument usually provides the investor with the right to appoint its own representative to the board of directors, and usually enables the investor to take voting control of the board of directors. The investor is essentially acquiring management control of a venture, and infusing funds into it with a view to taking a gamble that the team will be able to beat the odds and build a business that has a substantial value in future.

If the acquisition of preferred stock were to be used as the basis for valuation of the startup venture, how would we account for the following rights acquired by the investor?

- Liquidation preference. When the Company is acquired, or the assets liquidated, the proceeds are not shared equally among each of the shareholders. The founders and common stock holders stand in line behind the preferred-stock holding investors. Only once the preferred stockholders have redeemed all the funds they invested22, or multiples of the funds they invested , do the common stockholders get to share in the proceeds. Often, there’s nothing left after the liquidation preference has been exercised by the investors for the founders and common stock holders to share in the proceeds.

- Anti-dilution rights. Investors are protected from dilution of their shareholding through manipulation of the conversion rate that defines the rate at which preferred stock is converted to common stock at IPO23.

- Participation rights. The investor has a right to invest to maintain a certain shareholding percentage in future rounds of financing.

- Right to appoint directors. The preferred stock comes with rights to appoint directors, and substantial rights to appoint officers and management.

- Voting & veto rights. Preferred-stock holding investors have a right to veto a decision to sell the Company, raise finance, and make other strategic decisions.

- Co-sale rights. The founders and common stockholders are restricted from selling shares (pre-IPO), without investors having the opportunity to sell shares.

- Drag-along rights. The majority shareholders have the power to force minority shareholders to sell shares if the majority decides to sell the Company.

- Redemption rights. The investor has the right to demand the Company repays the funds invested, often with interest.

It’s hardly reasonably to just ignore these rights, and pretend the investor acquired regular common stock, without any of these rights, in order to use the venture investment as a basis for startup valuation. Perhaps some mathematical and business genius in future might be able to quantify each of these rights acquired by investors and factor this into the valuation calculation when appraising a venture-capital backed startup. However, I’m sure any approach is going to be subject to a great deal of debate and will be open to criticism.

A Harvard study24 reports that at least 70% of venture capital backed startups fail, and the startup venture can be considered a speculative gamble rather than a set of assets with substantial value. The odds of converting an early-stage venture capital investment into a profitable financial return are slim and the majority of venture-backed startups journeys end in a shuttering of the business and liquidation of the assets, where the Company’s assets fetch prices measured in thousands rather than millions of dollars.

A person can buy a casino chip for $5 but this does not mean that the plastic chip itself is worth $5 or that the value of the gaming table where the chip is gambled has a value calculated as the sum of the value of all the chips on the table. The chip represents a right to play the casino game and it’s unreasonable to infer from the price paid to use the chip what the value of that chip might be worth as an independent asset, or what the value of the casino game, or the table where the game is played might be worth. Likewise, if an investor invests $1m to acquire 10% of all the common stock in a startup venture, in the form of preferred stock, this does not mean that all the assets, or the venture itself would be worth $10m to an acquirer.

Shares in a startup venture can be compared to casino chips, and it’s not realistic to determine the value of an early stage startup’s assets from the price the investor has paid to take control of the startup via preferred stock and take the gamble that the investor and management is able to guide this startup to success in future years. A share of preferred stock is far superior and much more valuable than a share of common stock25. This two-tiered stock arrangement distorts any enterprise valuation calculations derived from a sale of preferred stock to investors.

Imagine you founded a startup company. After raising $5m venture capital but you still held 50% of the shares. BigCo offers $10m to buy your company. How much do you get for your shares if you accept BigCo’s offer?

You would NOT get $5m for your shares. If the liquidation preference was 1X, you would get 50% of $5m i.e. $2.5m.

If the liquidation preference was 2X, you would get 50% of nothing—i.e. $0.00. The VC takes multiples of the $5m investment before you get to share in the remainder.

22Almost all venture capital investments are structured using a “participating preferred” stock arrangement.

23The most common formulas used are the Weighted Average and the Full Ratchet.

24Performance Persistence in Entrepreneurship, Harvard Business School, Gompers, Kovner, Lerner, Sharfstein http://www.hbs.edu/research/pdf/09-028.pdf: “..a venture-capital-backed entrepreneur who succeeds in a venture (by our definition, starts a company that goes public) has a 30% chance of succeeding in his next venture. By contrast, first-time entrepreneurs have only an 18% chance of succeeding and entrepreneurs who previously failed have a 20% chance of succeeding.”

25 According to the SEC, an early-stage startup can have preferred stock valued at 10X the price of common stock.

Valuing Startup Companies Using a Comparables Approach

Venture capital investors are somewhat secretive about their investment transactions but there are some database services available that report the funds injected and investment terms surrounding venture capital investments26. From this data, it can be possible to liken one startup with others in order to make a comparables-based valuation. Trends in liquidation preferences, valuations and various issues of interest to venture capital investors are published by law firms and others involved in the Silicon Valley infrastructure27. These surveys can help appraisers understand market activity and determine the current trends in valuation and deal terms, generally organized by industry sector and stage of company (seed stage, early stage, etc.).

Repetition leads to familiarity and individuals involved in a large number of deals, like investors and corporate buyers, develop a rule of thumb—an awareness, conscious or unconscious—of what seems to be the market rate for companies at various stages of growth. The rule of thumb is based on comparable deals, the investors’ appetite for the investment, competition among competing buyers and the momentum generated by the Company.

A hypothetical investor might value a seed stage company with fair amount of momentum at $1m to $3m; and if the Company has generated impressive momentum, perhaps achieving milestones and generating a positive buzz in the industry, the valuation range could increase to between $5m and $15m.

A company in the expansion stage with good momentum, perhaps signing up significant customers, might be valued at between $10m and $50m; and a company preparing for IPO in the mezzanine stage, with impressive momentum could be valued at $200m+.

This type of comparables-based rule of thumb guideline may not be very scientific, but it does reflect the way many seed-stage and early-stage startup companies are valued by venture capital investors.

26As an example, see the Valuation & Deal Term Database from VC Experts (https://vcexperts.com/vat/companies).

27As an example, see the reports and surveys published by Fenwick & West (http://www.fenwick.com).

Valuing Startup Companies Using a Cost-Based Approach

If you formed a new startup, opened a bank account, deposited $5m into the bank and immediately ran a valuation of the Company (before incurring any debts, commitments or doing anything at all), it would be reasonable to assess the value of the Company at $5m, on the basis that this is the cost of replacing or replicating the Company. This would also represent the liquidation value, as the $5m in the bank is readily available—a highly liquid asset.

After the Company has been operating for some time, and the funds in the bank have been depleted, the relationship between the value of the business and the costs incurred becomes more difficult to justify. Let’s imagine that after a year, the bank balance has been depleted from $5m and now the bank has a balance of $12.56. Is it reasonable to value this Company at $5m based on the fact that investors injected $5m and the Company has incurred $5m28 in setup costs? As time passes, the argument becomes more difficult to defend.

We can, of course, estimate the cost of replacing or replicating virtually anything and there are situations where the value of a startup company could be estimated based on these costs.

Where startup has nothing more than technology, such as software, to offer a potential acquirer, the cost of replicating the technology will often be used as the basis of valuation for the acquirer. We will discuss this much further in a subsequent chapter29.

28OK, as there’s $12.56 in the bank, we can assume $4,999,987.44 has been withdrawn to cover costs.

29See Chapter on the valuation of Product Lines, below.

Valuing Startup Companies Using an Income-Based (Discounted Cash Flow) Approach

In the seed and early stages of startup development, sales and earnings projections may be so speculative that they are not taken seriously at all, and may be too unreliable to form the basis of valuation. Reflecting the highly speculative nature, and the risks involved, the discount rates commonly applied to startups by venture capital investors is in the range of 25-75% per year. As it may take the average high-technology startup 5-10 years before cash flow turns positive, the net present value of those positive cash flows can be very small after the discount rate is applied for each year. One dollar earned in year 10, with a compound discount rate of 60% (applied each year) has a net present value of less than 1 cent today. So, the earnings of the Company can never justify an investment based on a discounted cash flow analysis of the Company’s projected retained earnings.

However, investors do use the discounted cash flow model when valuing early stage startups and they focus on potential terminal value—the value of the Company at the point where the investor can exit (and sell shares) via M&A acquisition or IPO. Although the cash flows generated by a technology startup may be negligible, the price paid by a corporate acquirer or a Wall Street investor in 5-10 years may be substantial, and justify an investment when discounted to net present value today.

When the discounted cash flow method does not focus on cash-flows generated by earnings, and focuses exclusively on the potential value of the entire enterprise at exit (such as IPO or M&A acquisition), this technique resembles the Return on Investment30 method of valuation.

30Otherwise known as the “Venture Capital” method. See Return on Investment—How Venture Capital Investors Perform “Valuation” Calculations in Early Stage Startups, above.

Driving Demand & Increasing the Price When Selling Shares in Startup Companies

We have learned from the law of demand 31, that when management is looking to increase the price of shares, representing the valuation of the Company, the most effective technique is to introduce additional competing buyers.

If you’re raising a round of funding, the introduction of additional investors, each bidding to make the investment, will help management negotiate and justify a higher price. If you’re selling the whole company, several competing acquirers will likewise push up the price.

The best way of introducing buyers in the form of investors or corporate acquirers is to demonstrate marked progress in the business milestones achieved, and create a positive buzz around the Company. Customer wins, growing sales results, positive press coverage and customer testimonials all demonstrate positive momentum in the Company and attract potential investors and acquirers.

31 See Market Forces of Supply & Demand, above.

Valuation for Later-Stage Investment Funding

Where an early stage startup may have little or no historical performance on which to base a value calculation, revenue, earnings and other performance measures may become useful for a later-stage financings. Once the startup matures, generates revenues (and hopefully profits), the valuation methodologies we discussed in relation to established businesses will be adopted32.

As the Company starts to generate sales revenues, valuation methods focused on earnings and revenue performance may start to become relevant. At this stage, the value is often determined by the Company’s revenue. If comparable private companies in the same sector have recently been acquired for 3X their annual revenue, it would be reasonable to value of your company at 3X the annual revenue.

The financial projections of management may begin to hold some credibility, it may not be long before incoming cash exceeds the out flowing cash, so the Discounted Cash Flow method may be a viable valuation technique.

The value may also depend on the type of investor leading the round. New investors anxious to acquire a stake in the Company will tend to offer higher valuations than existing shareholders.

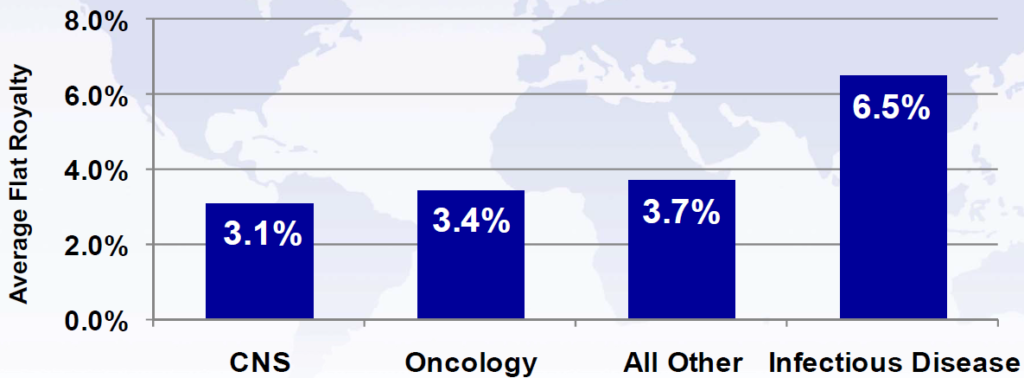

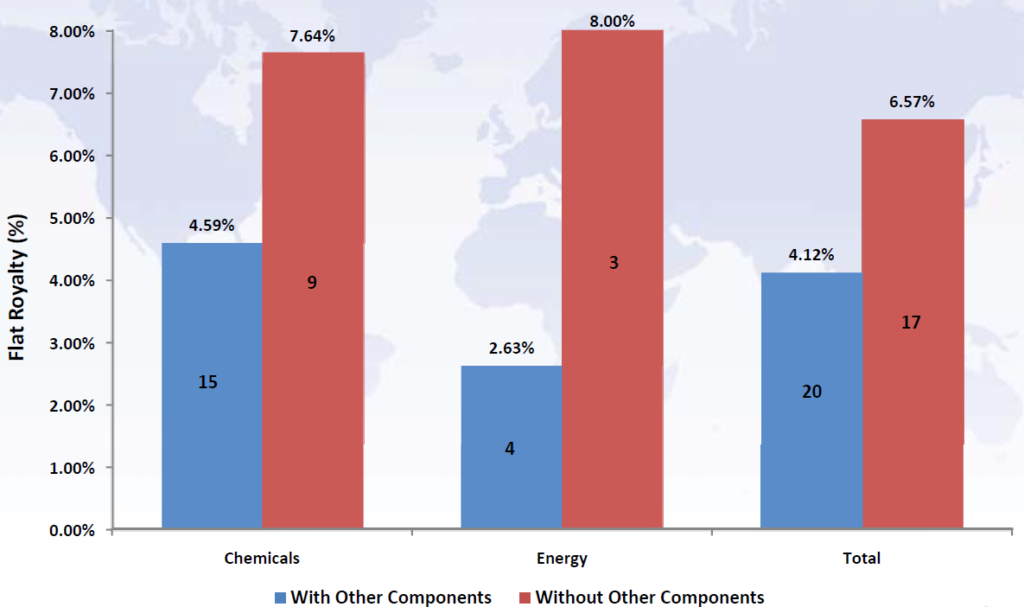

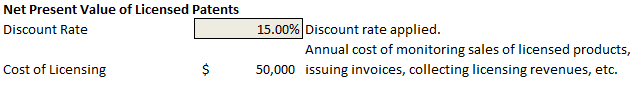

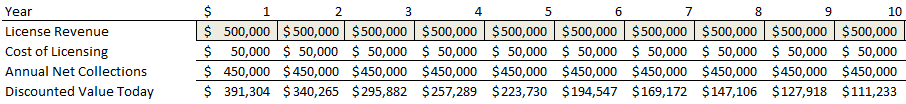

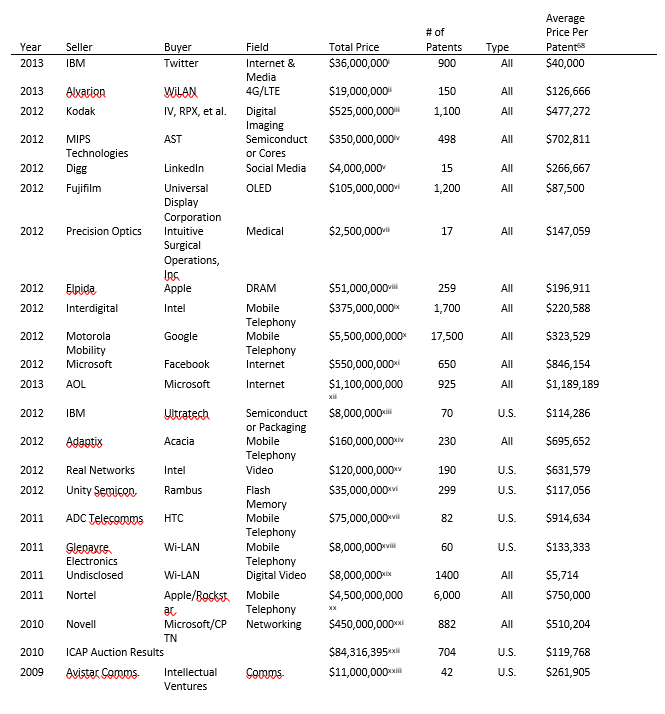

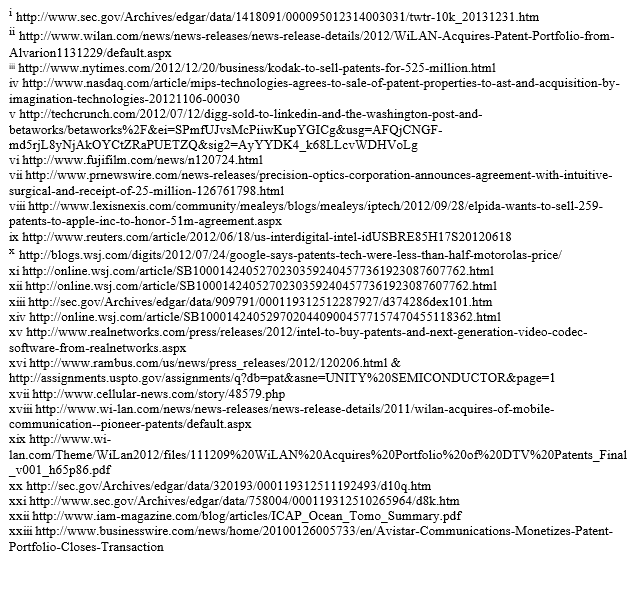

When it comes to a strategic round of funding, a corporate strategic investor will often agree to a higher valuation than a pure venture capital investor. Where venture investors are looking exclusively at the financial return, the corporate investor may consider other synergies and benefits to their parent company. For example, Intel has an interest in driving adoption of Intel chips, and often makes investments in startups developing technologies that will drive the growth in sales of semiconductors. By financing the startup, Intel may benefit from resulting chip sales, but the venture capital investor benefits only from the financial return. So a strategic investor like Intel may be able to justify a higher valuation than a VC.